Background

The Dubai First brand was launched in 2007 and has developed a reputation for outstanding customer service and award-winning products. The Dubai First business and brand have since been transferred and are now owned by First Abu Dhabi Bank (FAB). FAB is the UAE’s largest bank and one of the world’s largest financial institutions, offering an extensive range of tailor-made solutions, products, and services.

They have an impressive range of Dubai First credit cards. They continuously identify opportunities in the credit card market. With their sector-specific focus and innovation, redefined the credit cards landscape across the region.

Goal

Design an application for banking which puts the user’s necessities in an intuitive position. In addition, use a user-centered approach to aid the user in locating essential contextual features.

Role

I was responsible for the user experience design and usability testing. From uncovering the users pain points from the user research reports to proposing solutions to address the users pain points. Although I was the sole designer on the project, I collaborated closely with a product manager and the agile development team.

Empathize with users

User Interviews

The quantitative interview conducted with participants shows that:

- 50% are male while 50% are female.

- 40% out of the interviewed participants falls within the range of 18-25years,

- 55% of them falls within the range of 26–35years, while 5% is 36years and above.

- Only 60% of the people that I interviewed use the app while the remaining 40% don’t use the mobile app.

- 80% uses other credit card apps for their seamless transactions.

- 80% of users use the banking app for utility payment while 20% uses it for savings.

Furthermore, we tried to get feedback from users with a one-on-one interview based on their overall feel of the credit card apps and based on their task. This gave us a set of pain points I was able to summarize into the following:

- The registration process was long.

- Inactive Fingerprint

- Inability to view older transactions

- They had issues changing their transaction pin

- There was no easy way to reach customer service.

- There are usually network issues while using the app.

- App loads slowly and it is not easy to navigate

- The app is not visually appealing

Persona

Throughout the interviews, I noticed that users had difficulty understanding certain features and terminology of the apps. Some tasks sent them in rounds trying to find it. They also were quite unsure if some transaction that they hadn’t carried out before was free or if it was charged. Also there were certain issues that they said out loud that bothered them.

- Persona #1: I regularly use simple activities like checking balance and transactions. But it is the less frequently used options stuff that I have difficulty finding and don’t really understand.

- Persona #2: I regularly send money to friends when bills are split but it is such a lengthy process, I wish it were easier.

- Persona #3: New user in new country with new banking system.

Thus I was able to identify the personas and their key pain points.

Defining the Problem

After identifying and analyzing users’ pain points, I defined the following common ones that most users were having trouble.

Pain Point #1: Navigation

Users had to navigate a lot for common tasks such as finding the current balance across accounts, balance, recent transactions and transferring money to others.

Pain Point #2: Discoverability

New users or rather finding less used option were difficult and they struggled to find simple options like card payment, the due date and the feature to find ATM, etc.

Pain point # 3: Clarity

Some transactions didn’t make any sense at all. This confuses the user when he/she tries to recall what the transaction was made for.

Pain Point #4: Forgetfulness

There are times when the user doesn’t have enough money to carry out a transaction and would forget to carry it out at a later point in time.

Pain Point #5: Panic

When it comes to money, everyone panics and no one want to lose their hard earned money. Apps used by the user didn’t seem to help this. And this is one of the rarely used features but an extremely important one in times of need.

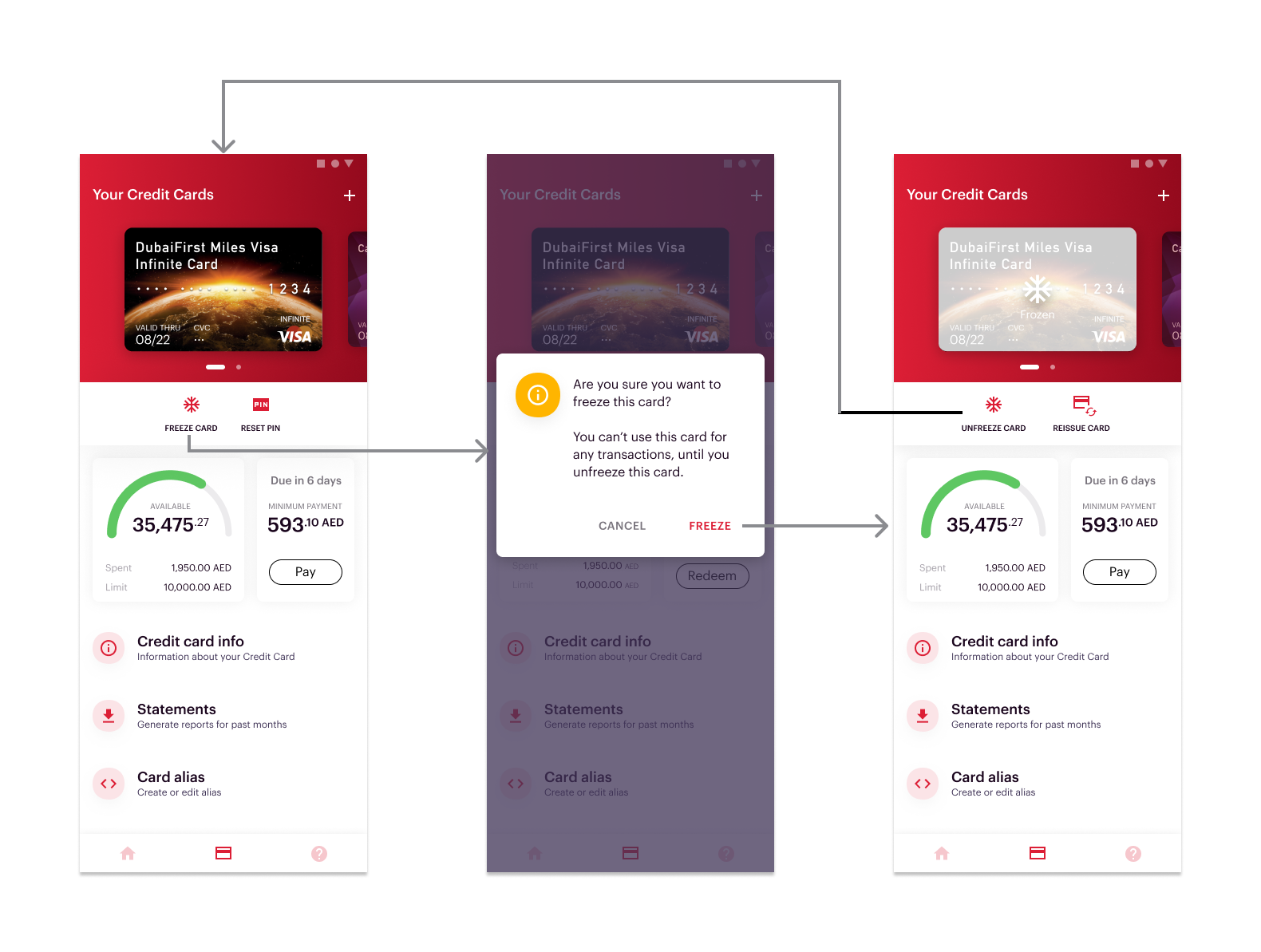

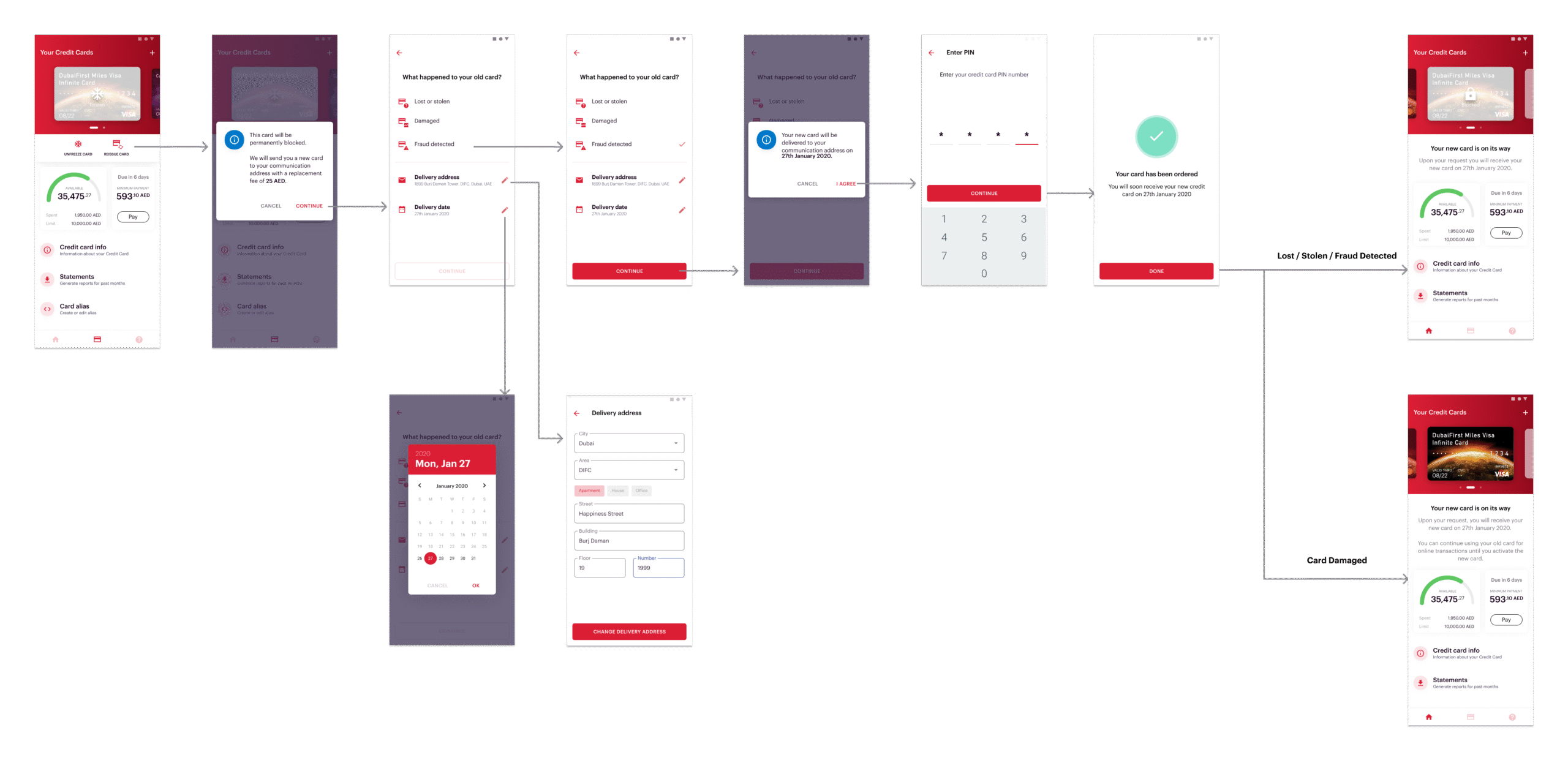

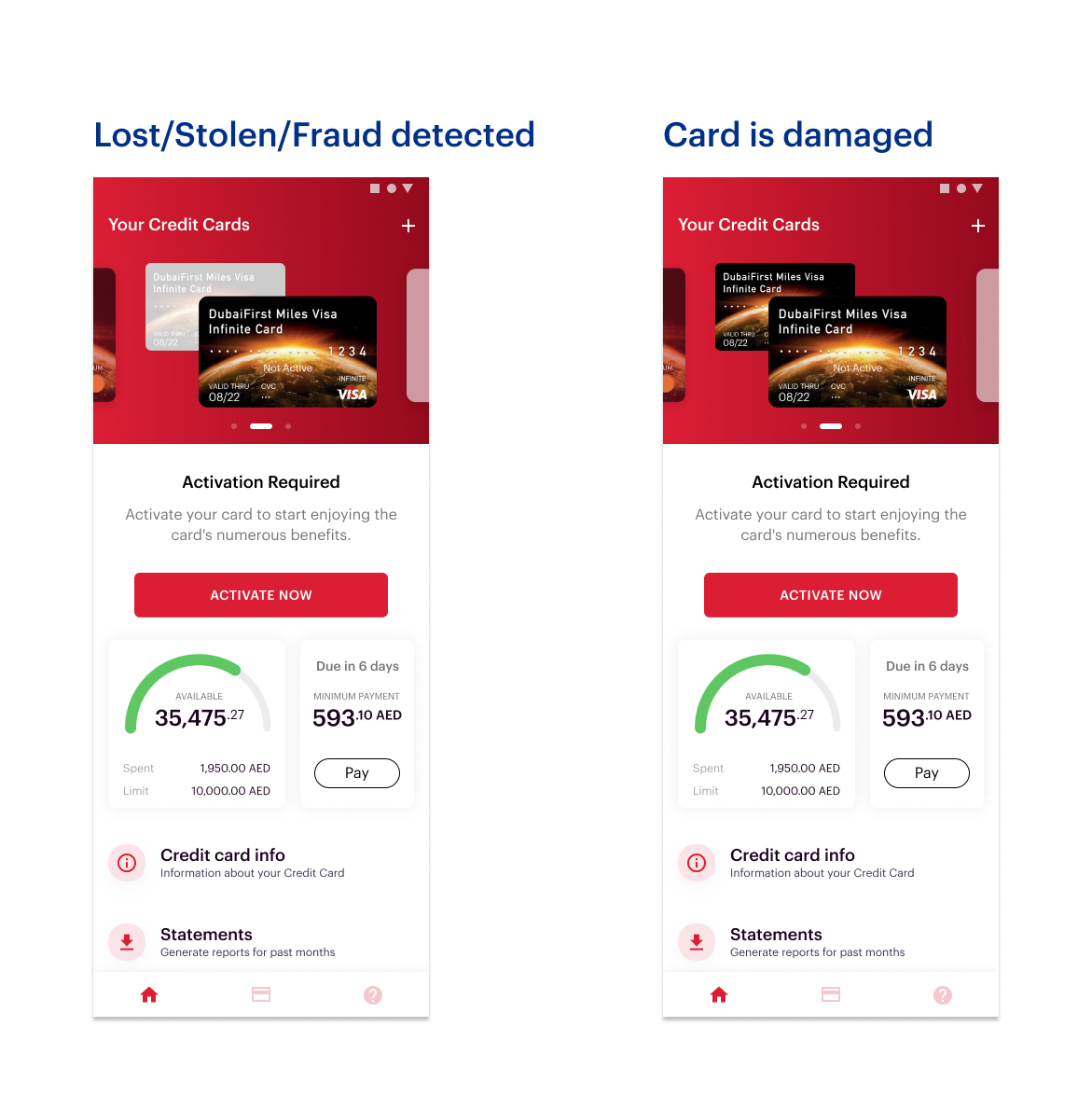

Visuals - Freeze & Re-issue Card

Freeze card

Re-issue card

Card not activated

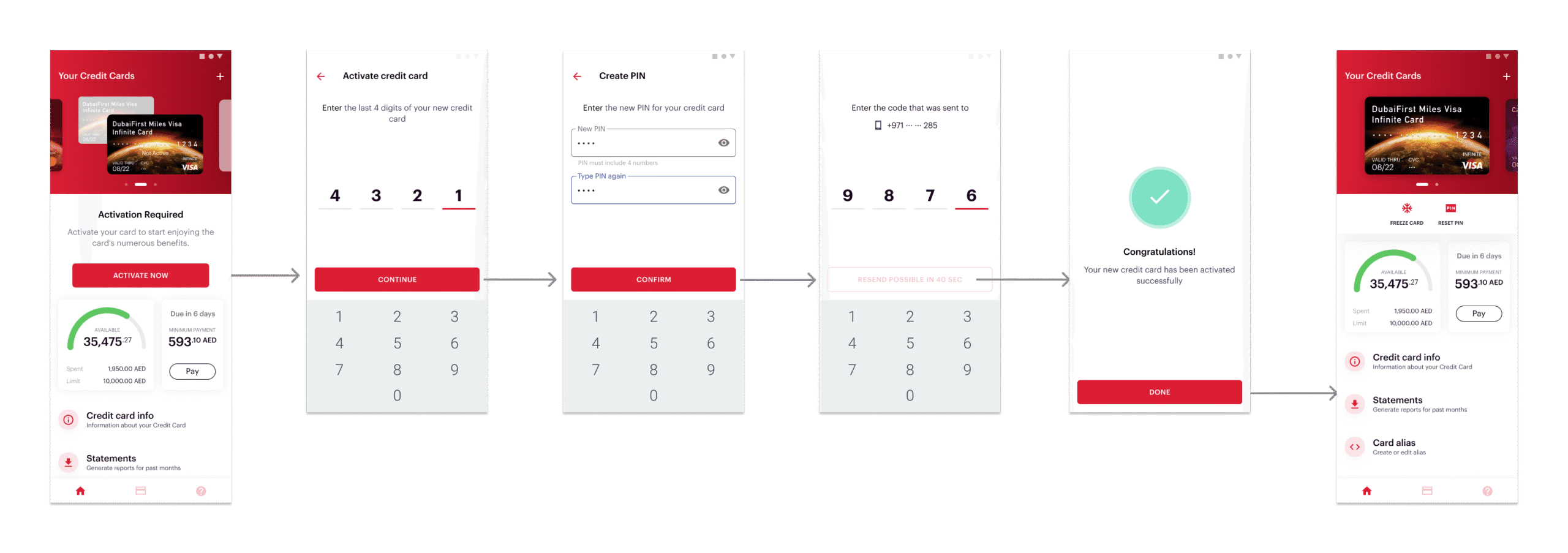

Activate new card