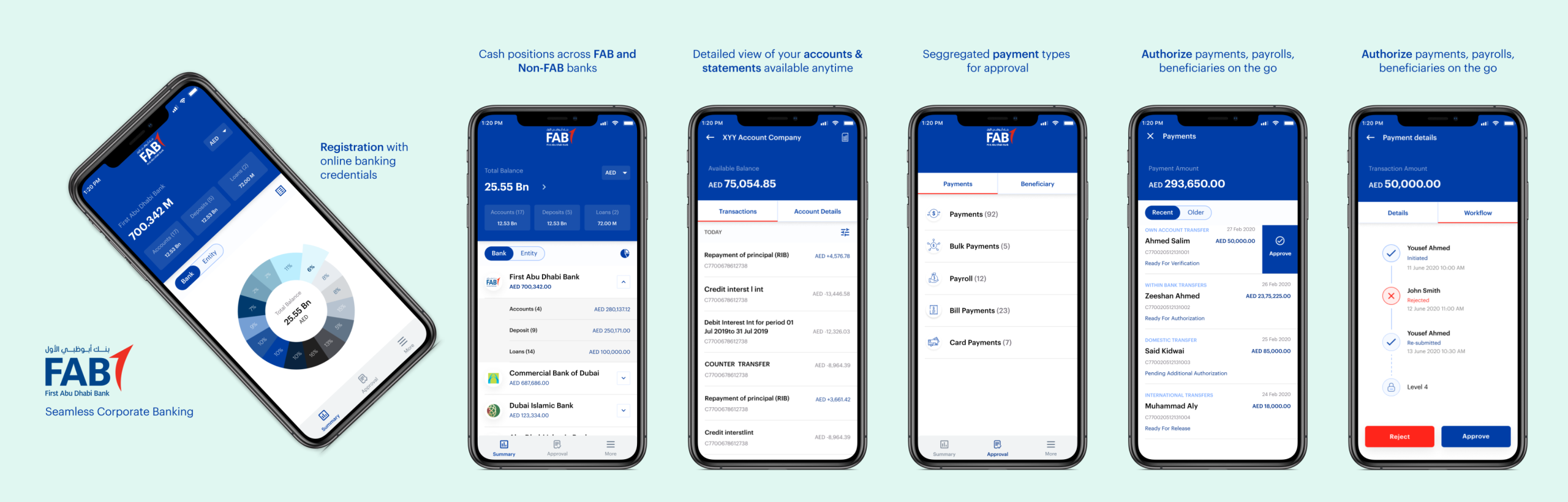

Project Brief

FAB’s Corporate Banking Mobile App for their customers provides enhanced and seamless mobile banking experience from anywhere and anytime to manage their global transaction business.

Key Features include:

- Stakeholder InterviewGlobal Cash Position across FAB & other banks

- Consolidated and Detail view of Accounts, Deposits and Loans

- Transaction Enquiry & Statements Including Advice

- Initiate & Authorize Single Payments & Transfers

- Authorize Bulk & Payroll Payments

- Creation, Authorization & Maintenance of Payees & Beneficiaries

- Digital Mobile Cheque Deposit

- View Cheque Status, Cheque image & Return Advice

- Device Management and Biometric enrollment

My Role

- Stakeholder Interview

- Product Audit

- Competitor’s Analysis

- User Persona

- User Journey Map

- Information Architecture

- Wireframes

- Visual Design

- Prototype

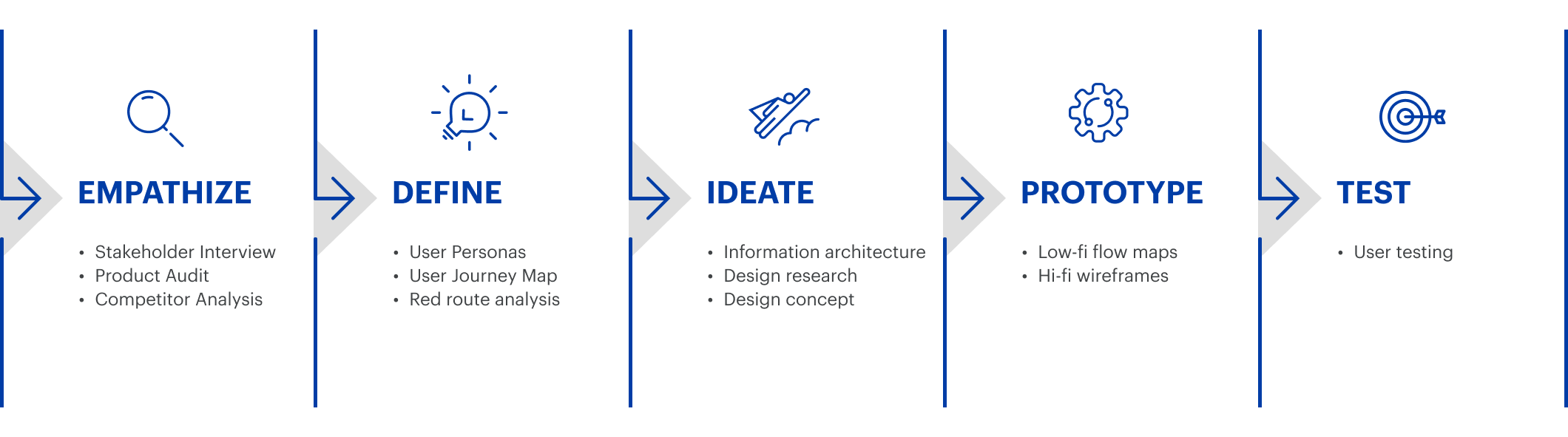

Design Process

Stakeholder’s Interview

One of the biggest barriers is that large teams often find it difficult to reach an common understanding. Everyone has a unique perspective on the company’s strategy and the new product’s goals. I started the research stage by conducting an interview with Digital stakeholders. Through this, we were able to determine the general business specifics of our client and their motivation for redesigning their existing product..

- What is important for the company?

- Where is it going?

- What is the role of new product in whole strategy?

- What expectations & may be fears, does the company have?

The Process Audit

After obtaining a thorough understanding of the company’s philosophy, strategy, and goals, I researched their current solution and identified its flaws. At this stage, it is crucial not to neglect the primary product value and benefits and look at the product from the user’s perspective. Hundreds of functions and user scenarios can easily mask the true value of the product.

Competitor Analysis

By analyzing our major competitors, we’ve determined our strengths and weaknesses. By understanding these, we can identify opportunities to develop and surpass competitors.

- Learning from competitor’s success & failures

- What are the advantages in the competitor’s customer experience?

- What makes their user struggle?

- How do they position themselves in market?

User Personas

User Personas determined based on

- Who are the target users?

- What is their story?

- What is their background?

- What is their demographic (e.g., gender, education, age)?

- What do they care about?

- What are their pain points or challenges?

- What expectations do they have when using a mobile application like mine?

- How do they use applications and other technology?

- How does our product specifically meet their needs and expectations?

- Which features do they require to keep using an application?

- Which mobile operating system do they prefer (iOS or Android)?

- What level of sophistication do they have on their phone?

- Will this app to be installed on the corporate phone or on their personal mobile?

User Interview

The most valuable insights and data were obtained through user interviews. This provides an emotional connection with potential users and enables us to feel their pain points and empathize with their current experience.

- What are their interests and hobbies?

- What is the ideal information they want to see in the dashboard?

- Do they want to access different banking features from the website?

- How often do they login to the portal?

- What challenges do they face in accessing the tool?

Story Points & Sprint Planning

Story points are units of measure for expressing an estimate of the overall effort required to fully implement a product backlog item or any other piece of work. Teams assign story points relative to work complexity, the amount of work, and risk or uncertainty.

- Sprint progress

- Issue type breakdown (Epic)

- Sprint Commitment

- Deployment frequency

Interaction Models

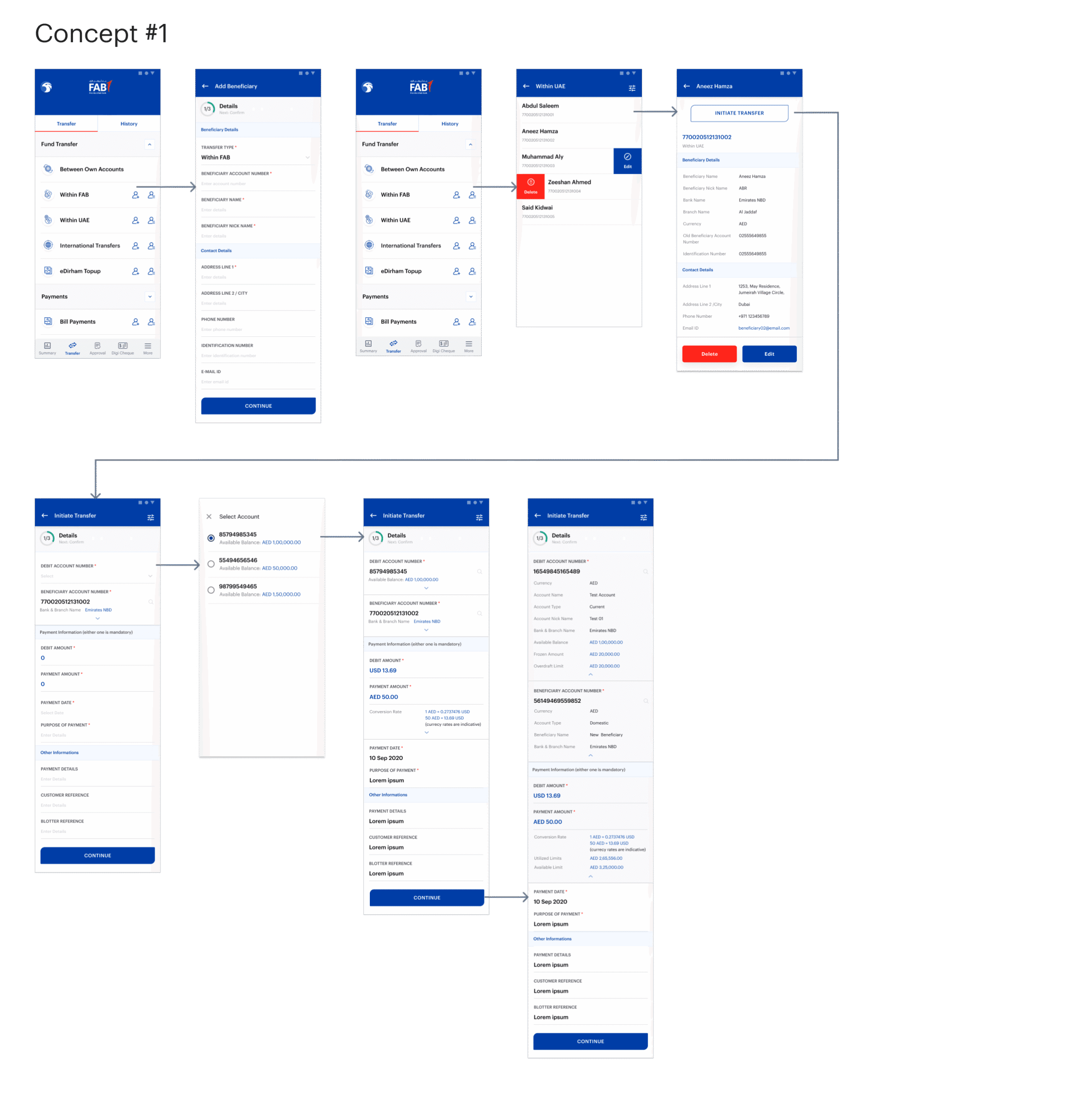

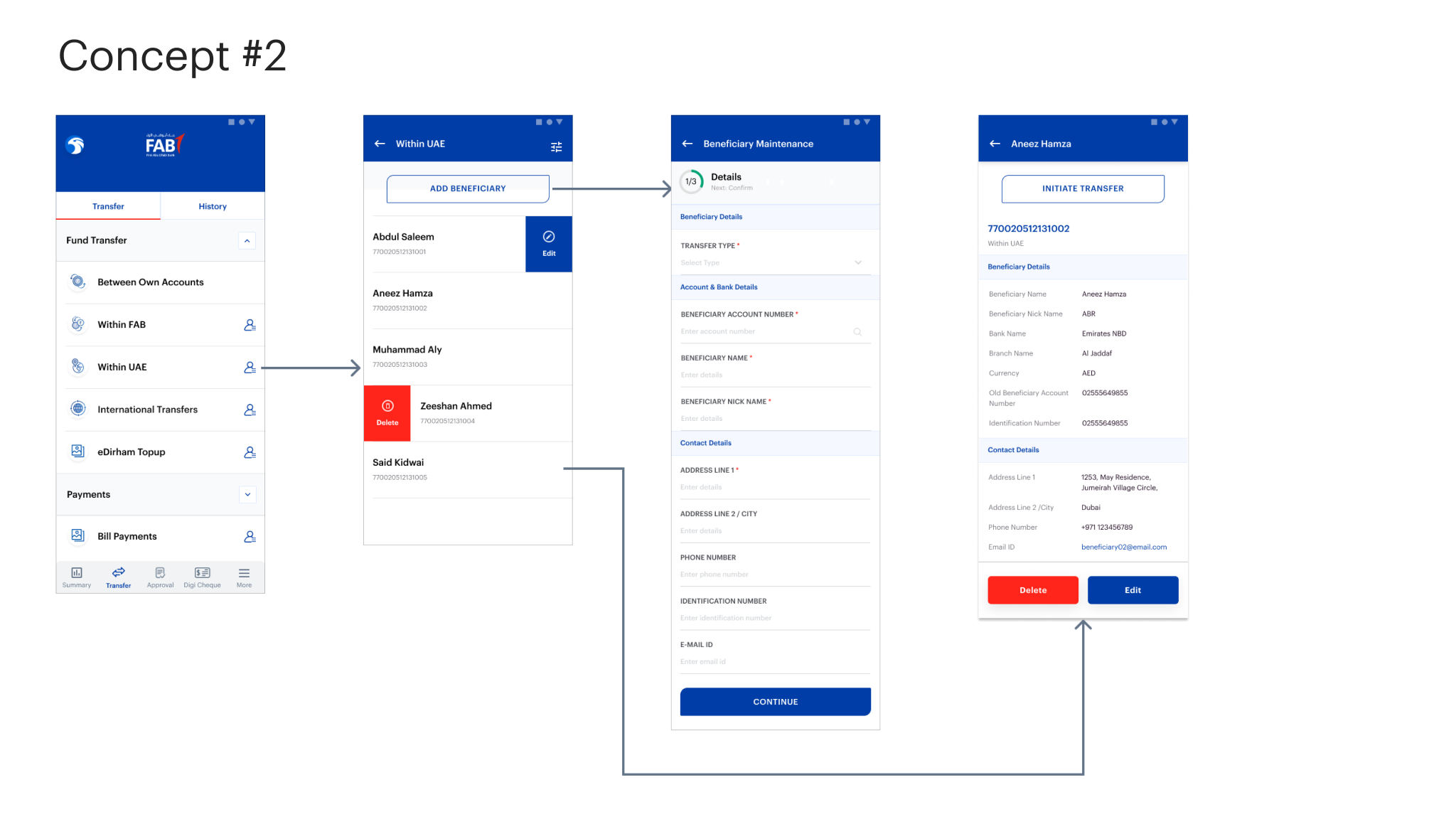

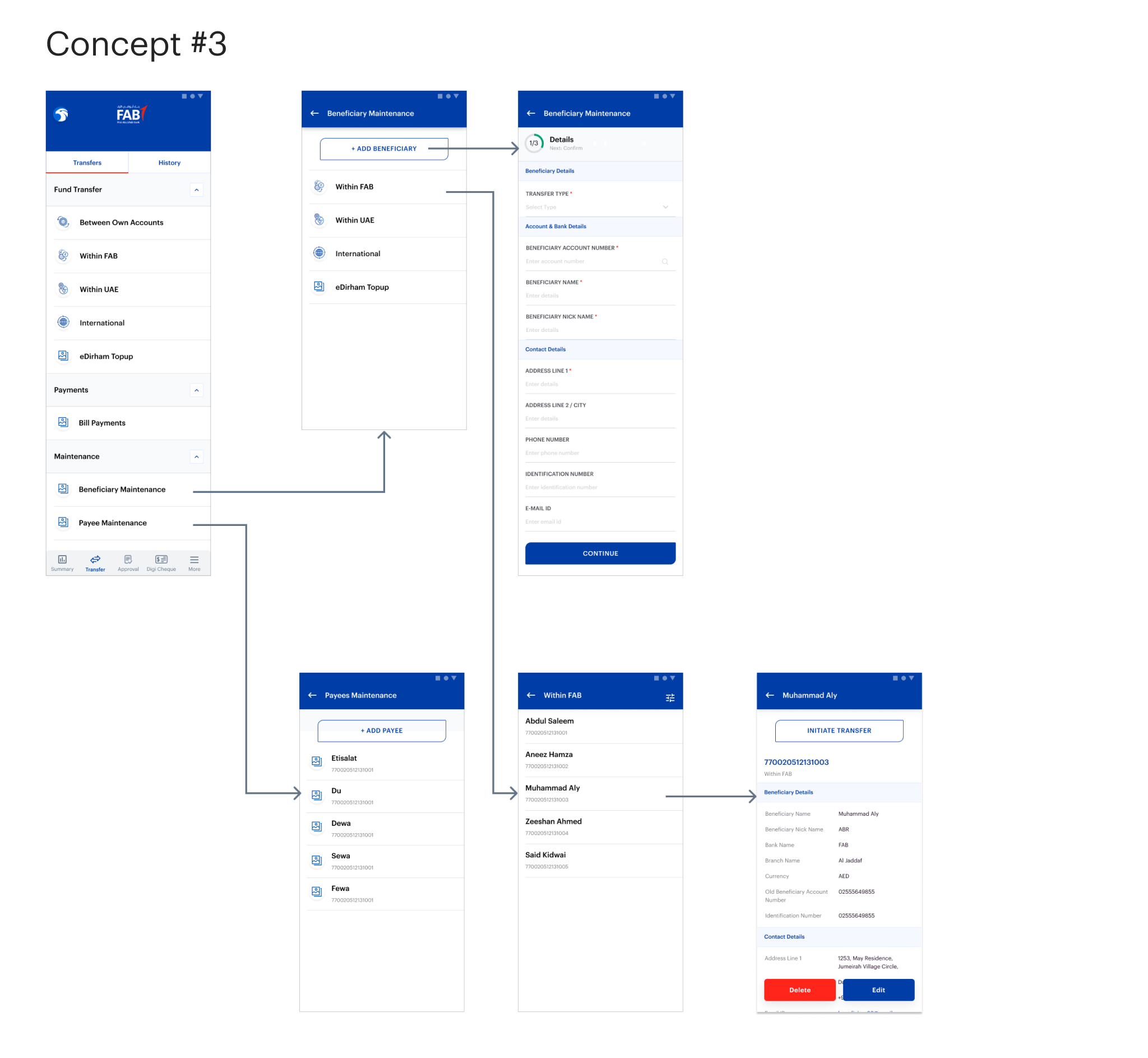

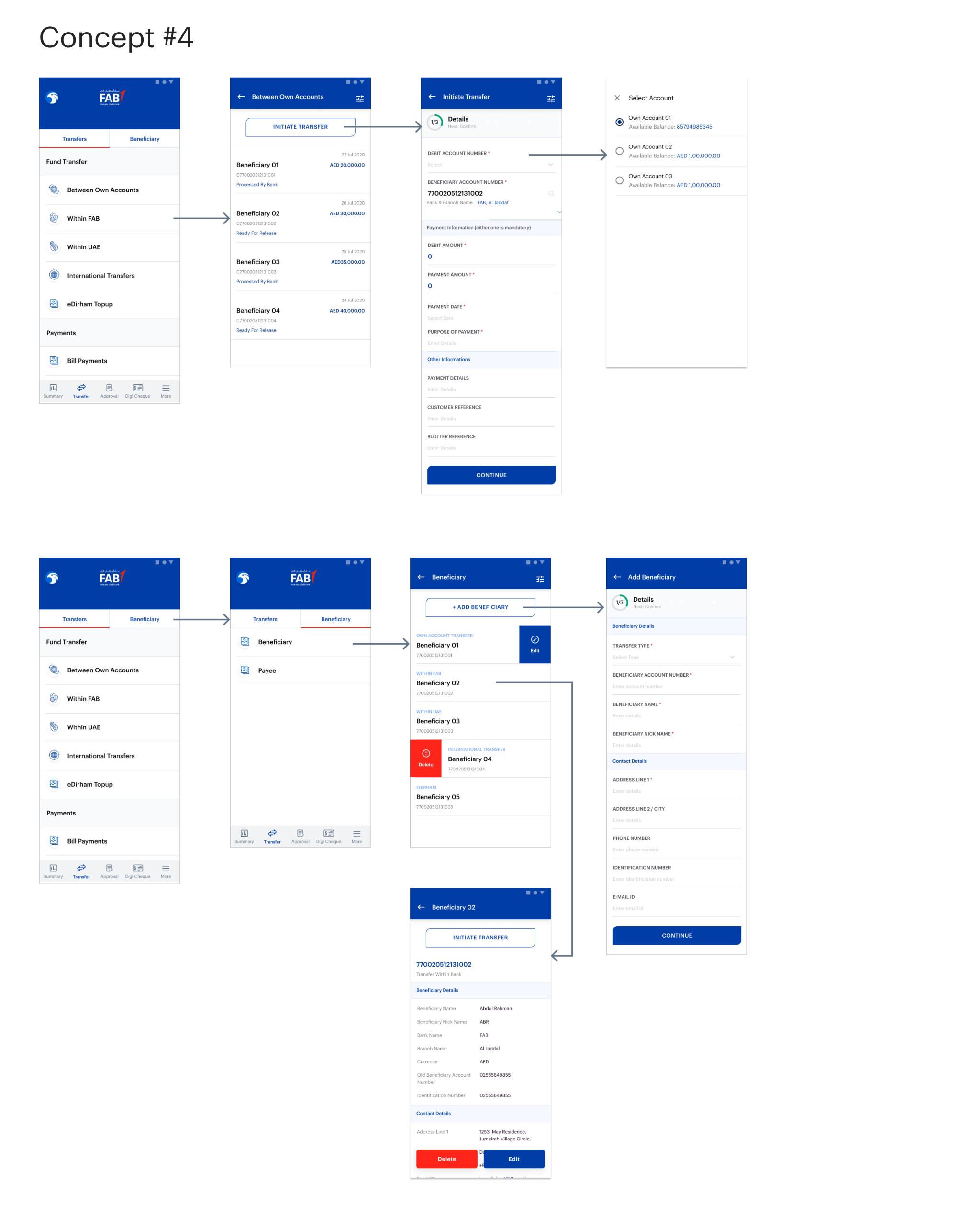

Final Visuals (Concept 4)